For distributed energy generation developers, New York's Value of Distributed Energy Resources (VDER) mechanism has proven to be a high-value alternative to the New York Independent System Operator (NYISO) wholesale market. Thanks to the higher returns and lower uncertainty provided by VDER's unique 'value stack' structure, which compensates distributed energy resources such as solar or batteries based on when and where they provide electricity to the grid, investment in small-scale renewable projects has soared. However, changing realities in NYISO will create unintended consequences for VDER compensation that policymakers and developers will need to take into consideration, especially as the distributed energy generation market continues to evolve.

In a recent Ascend Analytics webinar, Dr. Shlomy Goffri, VP of Valuation and Portfolio Management, joined Caroline Zechter, Director of Community Solar, and Robert LaFaso, Director of Forecasting and Valuation, to discuss VDER-related revenue outlooks, challenges and opportunities for solar, storage, and hybrid battery system operations, as well as Ascend's view of how New York's distributed energy generation compensation mechanism may evolve as grid realities change.

New York has among the most ambitious clean energy targets in the US, with goals of 70% renewable generation by 2030, 9 GW of offshore wind by 2035, and 100% zero-emission generation by 2040.

As Ascend noted in a recent NYISO forecast preview, however, New York is likely to miss these targets. This is due to a variety of reasons, including concerns about rising energy costs, the cancellation of multiple offshore wind projects, and the termination of contracts for the Clean Path NY transmission line.

On the distributed side, though, a sunnier picture emerges. Despite a lack of progress relative to overall clean energy goals, New York did reach its target of installing 6 GW of distributed solar capacity a year early and recently expanded the target to 10 GW. This success has been driven in large part by VDER, which has facilitated the installation of approximately 2 GW of small-scale (less than 5 MW) renewable energy projects.

The VDER tariff functions as a 'value stack' compensation structure for distributed resources based on avoided costs, as shown in Figure 1. While closely tied to the wholesale market, VDER diverges in a unique way from traditional distributed energy resource tariffs: it is not tied to the retail rate of electricity. Instead, VDER compensates resources based on when and where they provide electricity to the grid, accounting for time of day and location of resource generation. VDER compensation is meant to reflect the actual benefits that a resource provides to New York’s electric grid.

The VDER value stack creates multiple opportunities for renewable energy project developers. The Energy Value component is equivalent to the hourly day-ahead Locational-Based Marginal Price (LBMP) for a relevant NYISO Zone. Hourly pricing creates energy arbitrage opportunities for both hybrid and standalone storage.

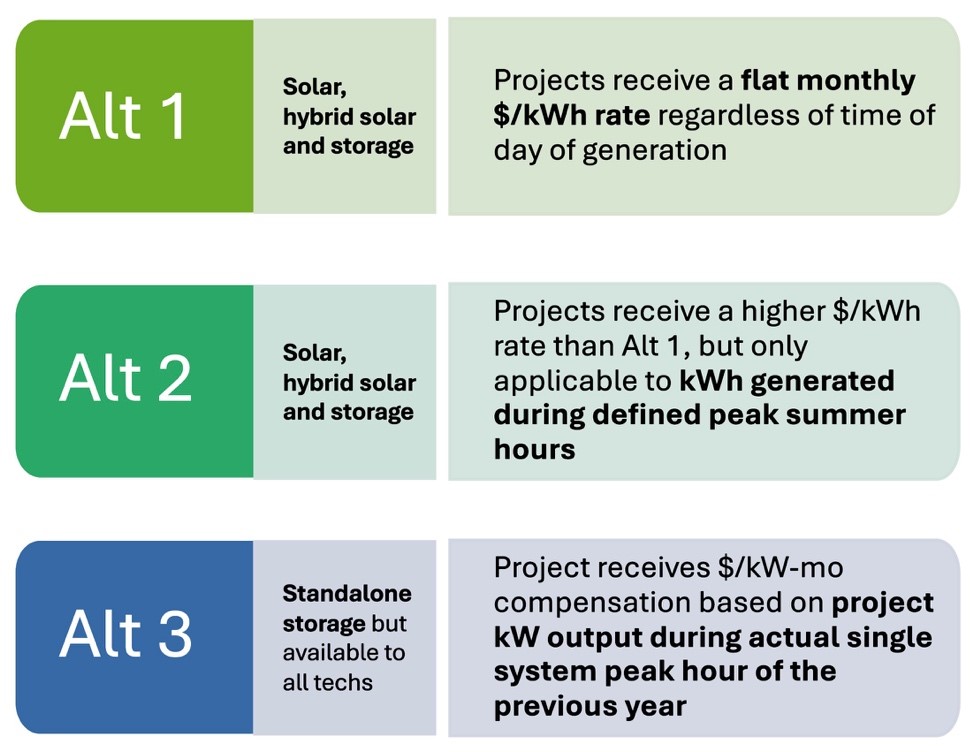

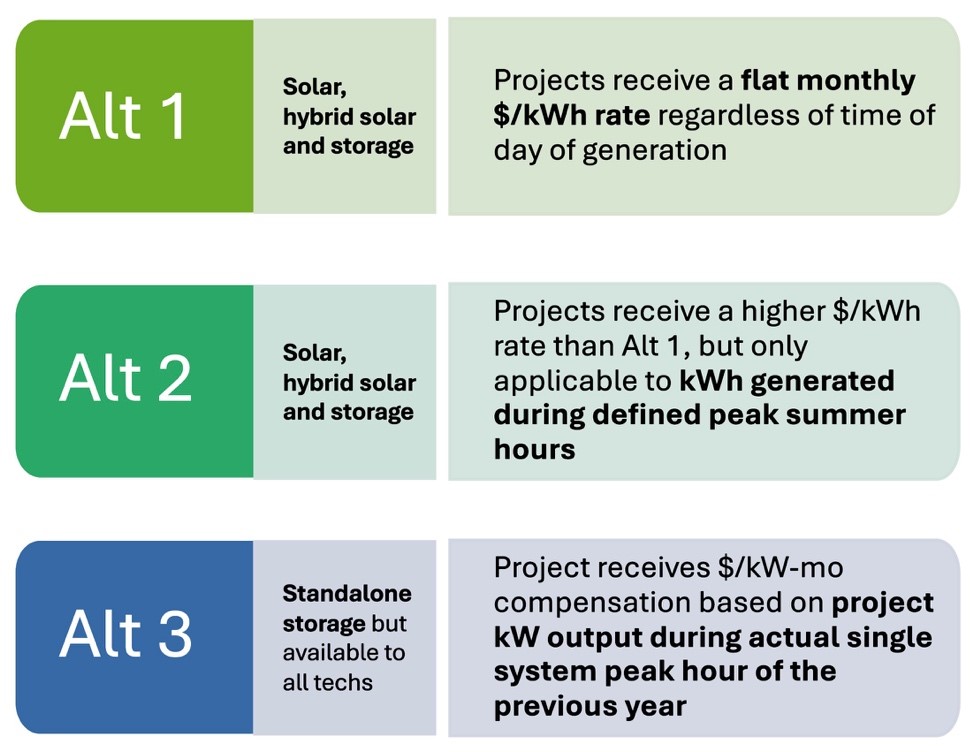

The Capacity Value (ICAP) is tied to wholesale capacity prices and is paid out under one of three alternatives, as shown in Figure 2. Significantly, hybrid projects that dispatch full capacity during the Alt 2 window, and standalone projects that dispatch full capacity during the single Alt 3 peak hour, receive full capacity accreditation – which represents an enormous opportunity for storage. Unlike the wholesale market, storage is not subject to effective load carrying capability (ELCC) deration, which means a higher capacity revenue potential in VDER.

The Demand Reduction Value (DRV) and Locational System Relief Value (LSRV) components of the VDER Value Stack provide significant additional value for projects in grid-constrained areas. Both lock in rates for 10 years, providing a measure of certainty for developers.

Additionally, the Environmental Value component of the VDER stack provides a source of guaranteed revenue for eligible distributed generation projects. Essentially a fixed REC available to solar projects and hybrid projects that charge from solar (though not to grid-charging storage), it is paid out per kWh of generation and is fixed for 25 years.

To maximize value with VDER, developers must consider several key elements, including zonal LBMP, zonal capacity prices, utility-specific DRV, substation-specific LSRV, interconnection and distribution hosting capacity, site control, and battery charging costs. In New York, regional variation in wholesale energy and capacity pricing trends continue to serve as major siting drivers. Unsurprisingly, capacity prices remain highest in resource-constrained Zones J (New York City) and K (Long Island), though Ascend expects capacity prices to rise significantly in upstate New York as well. Strong energy arbitrage opportunities exist in these zones, as well as in Zone F (Capital), where developers can take advantage of generally lower building costs.

Fully capturing value through VDER, however, requires energy analytics software, such as Ascend's PowerVAL/BatterySIMM, that provides energy and capacity price forecasts grounded in market fundamentals, hourly granularity of charging costs, and an accurate view of hourly system dispatch between retail charging costs and VDER revenue. By reflecting real world dynamics, the Ascend approach values project margins around 45% higher relative to standard tools such as the NYSERDA calculator.

VDER has proven to be a lucrative alternative to the wholesale market, due in large part to its fixed revenue components, high capacity revenue potential, and ability to facilitate shorter development cycles. And given its crucial role in incentivizing clean resource development in New York, policymakers and regulators have an interest in keeping VDER attractive going forward.

As the market evolves, however, emerging dynamics will necessitate rethinking some aspects of the program compensation structure. For example, increasing solar and storage penetration, as well as a shift to a winter-peaking system, will lead to longer peaks that often occur overnight. This is likely to trigger reform: serving only the system gross-load peak hour, in a system with a wide marginal peak, doesn’t contribute to system reliability. Absent reforms to VDER capacity accreditation, there will be increasing divergence between wholesale and VDER storage capacity revenues: ELCC values for storage participating in wholesale auctions will decline, reflecting storage’s limited ability to serve these longer peaks.

Ultimately, and even with potential market reforms, Ascend expects VDER to serve as an attractive incentive for hybrid and standalone storage systems in the long term. VDER will continue to represent the preeminent way for storage to get installed in Zones K and J, due to capacity accreditation, revenue stability and predictability, and attractive energy price dynamics.

Access the full webinar recording, which offers guidance for where, what, and when to add new distributed energy generation resources in NYISO. The webinar also offers VDER-related revenue outlooks, as well as analyses of challenges and opportunities for solar, storage, and hybrid battery system operations.

Trusted across hundreds of deals and more than $1B in transaction value, PowerVAL/BatterySIMM provides bankable revenue stacking forecasts and nodal-specific valuations for storage, renewables, and hybrid projects under multiple operating strategies across all ISOs. Contact us to learn more.

For distributed energy generation developers, New York's Value of Distributed Energy Resources (VDER) mechanism has proven to be a high-value alternative to the New York Independent System Operator (NYISO) wholesale market. Thanks to the higher returns and lower uncertainty provided by VDER's unique 'value stack' structure, which compensates distributed energy resources such as solar or batteries based on when and where they provide electricity to the grid, investment in small-scale renewable projects has soared. However, changing realities in NYISO will create unintended consequences for VDER compensation that policymakers and developers will need to take into consideration, especially as the distributed energy generation market continues to evolve.

In a recent Ascend Analytics webinar, Dr. Shlomy Goffri, VP of Valuation and Portfolio Management, joined Caroline Zechter, Director of Community Solar, and Robert LaFaso, Director of Forecasting and Valuation, to discuss VDER-related revenue outlooks, challenges and opportunities for solar, storage, and hybrid battery system operations, as well as Ascend's view of how New York's distributed energy generation compensation mechanism may evolve as grid realities change.

New York has among the most ambitious clean energy targets in the US, with goals of 70% renewable generation by 2030, 9 GW of offshore wind by 2035, and 100% zero-emission generation by 2040.

As Ascend noted in a recent NYISO forecast preview, however, New York is likely to miss these targets. This is due to a variety of reasons, including concerns about rising energy costs, the cancellation of multiple offshore wind projects, and the termination of contracts for the Clean Path NY transmission line.

On the distributed side, though, a sunnier picture emerges. Despite a lack of progress relative to overall clean energy goals, New York did reach its target of installing 6 GW of distributed solar capacity a year early and recently expanded the target to 10 GW. This success has been driven in large part by VDER, which has facilitated the installation of approximately 2 GW of small-scale (less than 5 MW) renewable energy projects.

The VDER tariff functions as a 'value stack' compensation structure for distributed resources based on avoided costs, as shown in Figure 1. While closely tied to the wholesale market, VDER diverges in a unique way from traditional distributed energy resource tariffs: it is not tied to the retail rate of electricity. Instead, VDER compensates resources based on when and where they provide electricity to the grid, accounting for time of day and location of resource generation. VDER compensation is meant to reflect the actual benefits that a resource provides to New York’s electric grid.

The VDER value stack creates multiple opportunities for renewable energy project developers. The Energy Value component is equivalent to the hourly day-ahead Locational-Based Marginal Price (LBMP) for a relevant NYISO Zone. Hourly pricing creates energy arbitrage opportunities for both hybrid and standalone storage.

The Capacity Value (ICAP) is tied to wholesale capacity prices and is paid out under one of three alternatives, as shown in Figure 2. Significantly, hybrid projects that dispatch full capacity during the Alt 2 window, and standalone projects that dispatch full capacity during the single Alt 3 peak hour, receive full capacity accreditation – which represents an enormous opportunity for storage. Unlike the wholesale market, storage is not subject to effective load carrying capability (ELCC) deration, which means a higher capacity revenue potential in VDER.

The Demand Reduction Value (DRV) and Locational System Relief Value (LSRV) components of the VDER Value Stack provide significant additional value for projects in grid-constrained areas. Both lock in rates for 10 years, providing a measure of certainty for developers.

Additionally, the Environmental Value component of the VDER stack provides a source of guaranteed revenue for eligible distributed generation projects. Essentially a fixed REC available to solar projects and hybrid projects that charge from solar (though not to grid-charging storage), it is paid out per kWh of generation and is fixed for 25 years.

To maximize value with VDER, developers must consider several key elements, including zonal LBMP, zonal capacity prices, utility-specific DRV, substation-specific LSRV, interconnection and distribution hosting capacity, site control, and battery charging costs. In New York, regional variation in wholesale energy and capacity pricing trends continue to serve as major siting drivers. Unsurprisingly, capacity prices remain highest in resource-constrained Zones J (New York City) and K (Long Island), though Ascend expects capacity prices to rise significantly in upstate New York as well. Strong energy arbitrage opportunities exist in these zones, as well as in Zone F (Capital), where developers can take advantage of generally lower building costs.

Fully capturing value through VDER, however, requires energy analytics software, such as Ascend's PowerVAL/BatterySIMM, that provides energy and capacity price forecasts grounded in market fundamentals, hourly granularity of charging costs, and an accurate view of hourly system dispatch between retail charging costs and VDER revenue. By reflecting real world dynamics, the Ascend approach values project margins around 45% higher relative to standard tools such as the NYSERDA calculator.

VDER has proven to be a lucrative alternative to the wholesale market, due in large part to its fixed revenue components, high capacity revenue potential, and ability to facilitate shorter development cycles. And given its crucial role in incentivizing clean resource development in New York, policymakers and regulators have an interest in keeping VDER attractive going forward.

As the market evolves, however, emerging dynamics will necessitate rethinking some aspects of the program compensation structure. For example, increasing solar and storage penetration, as well as a shift to a winter-peaking system, will lead to longer peaks that often occur overnight. This is likely to trigger reform: serving only the system gross-load peak hour, in a system with a wide marginal peak, doesn’t contribute to system reliability. Absent reforms to VDER capacity accreditation, there will be increasing divergence between wholesale and VDER storage capacity revenues: ELCC values for storage participating in wholesale auctions will decline, reflecting storage’s limited ability to serve these longer peaks.

Ultimately, and even with potential market reforms, Ascend expects VDER to serve as an attractive incentive for hybrid and standalone storage systems in the long term. VDER will continue to represent the preeminent way for storage to get installed in Zones K and J, due to capacity accreditation, revenue stability and predictability, and attractive energy price dynamics.

Access the full webinar recording, which offers guidance for where, what, and when to add new distributed energy generation resources in NYISO. The webinar also offers VDER-related revenue outlooks, as well as analyses of challenges and opportunities for solar, storage, and hybrid battery system operations.

Trusted across hundreds of deals and more than $1B in transaction value, PowerVAL/BatterySIMM provides bankable revenue stacking forecasts and nodal-specific valuations for storage, renewables, and hybrid projects under multiple operating strategies across all ISOs. Contact us to learn more.

Ascend Analytics is the leading provider of market intelligence and analytics solutions for the energy supply. The company’s offerings enable decision makers in power development and supply procurement to maximize the value of planning, operating, and managing risk for renewable, storage, and other assets. From real-time to 30-year horizons, their forecasts and insights are at the foundation of over $50 billion in project financing assessments. Ascend provides energy market stakeholders with the clarity and confidence to successfully navigate the rapidly shifting energy landscape.